5starsstocks.com

Introduction

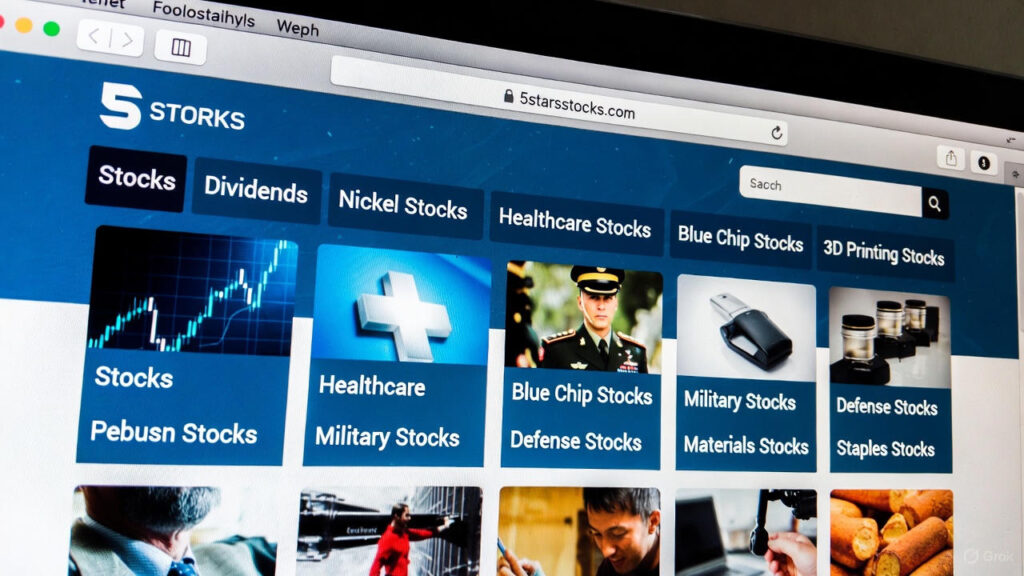

Hey there! If you’re dipping your toes into the stock market or looking to level up your game, you’ve probably heard about sites that make things easier. That’s where 5starsstocks.com comes in. It’s like a friendly guide that helps you find great stock ideas without all the confusion. Think of it as your go-to spot for learning about things like dividend stocks or nickel investments.

I remember when I first started investing—I was overwhelmed by all the numbers and news. But places like 5starsstocks.com break it down into simple bits. They focus on quality picks that could grow over time. Plus, they cover a bunch of areas, from healthcare to blue chip stocks. It’s all about making smart choices that fit your life. Whether you’re saving for a house or just want extra cash, this site can spark some ideas. Let’s dive deeper into what makes 5starsstocks.com tick and how it can help you.

What is 5starsstocks.com All About?

5starsstocks.com is a fun and easy website for stock fans. It shares tips on the best stocks to buy now. The site talks about different kinds. Like passive stocks for chill investing or value stocks for good deals. They have articles on nickel stocks too, which are big in batteries. I like how they explain things simply. No big words—just clear facts. For example, they might say a stock is strong because of its cash flow. This helps new folks understand.

The site also has sections on military stocks and defense picks. These are for people who want steady growth. 5starsstocks.com isn’t just lists. It teaches why a stock might be good. Think about lithium stocks—they’re hot for electric cars. The site shows top ones with reasons. I’ve used similar sites, and this one feels trustworthy. It reminds you to do your own checks. That’s smart because markets change. Overall, it’s a solid start for anyone curious about stocks.

Why Pick 5starsstocks.com for Your Stock Journey?

Choosing the right site matters a lot. 5starsstocks.com stands out because it’s user-friendly. It has fresh articles on best stocks. Like their guide on dividend stocks to buy in 2025. They list eight top ones, such as Johnson & Johnson (JNJ) for health care. It’s a blue chip with steady payouts. I once invested in something similar and saw nice returns over time. The site explains benefits, like getting money without selling shares.

They cover risks too, like market ups and downs. For nickel stocks, they pick six strong ones like Vale (VALE). Nickel is key for batteries, and 5starsstocks.com shows why it’s a buy now. They use real data from sources like the USGS. This builds trust. Plus, they talk about passive stocks for easy income. No need to watch daily. If you’re into 3D printing stocks, they have a category for that future tech. It’s all about helping you build a mix of stocks. I think that’s why folks keep coming back.

Diving into Dividend Stocks on 5starsstocks.com

Dividends are like gifts from companies. 5starsstocks.com loves them. They have a post on the best eight for 2025. Picks include Procter & Gamble (PG) for everyday items. It’s a staples stock with reliable cash. Why? Because people always buy soap and toothpaste. The site says these have low risk and steady growth. Another is Coca-Cola (KO), a fun drink company.

They’ve raised dividends for years. I tried dividend investing once—it felt like free money. 5starsstocks.com explains how to pick them. Look at payout ratios and cash flow. They warn about high yields that might be traps. For income stocks, this is gold. Mix in some blue chip ones for safety. The site suggests starting small and reinvesting. That way, your money grows. They also tie it to passive stocks. Just hold and collect. If you’re new, this section is a must-read. It makes complex stuff simple.

| Stock | Ticker | Category | Why Recommended |

|---|---|---|---|

| Johnson & Johnson | JNJ | Healthcare Dividend | Steady payouts, strong health products |

| Procter & Gamble | PG | Staples Dividend | Everyday needs, reliable income |

| Coca-Cola | KO | Beverages Dividend | Global brand, long history of raises |

| Realty Income | O | REIT Dividend | Monthly payments, real estate focus |

| Microsoft | MSFT | Tech Dividend | Growth plus cash returns |

Exploring Nickel Stocks with 5starsstocks.com

Nickel is exciting right now. It’s used in batteries for cars. 5starsstocks.com has a guide on the best six nickel stocks for 2025. Top pick: Vale (VALE), a big miner with class-1 nickel. They have deals with Tesla. Cool, right? Another is BHP Group (BHP) for their strong setup. The site talks about market outlook. Demand from EVs is up, but supply from places like Indonesia affects prices.

I learned from this that nickel has two types—class-1 for batteries and class-2 for steel. 5starsstocks.com explains risks, like policy changes. For materials stocks, this is key. They suggest mixing with lithium stocks for balance. Lithium is similar, used in batteries too. The site has a lithium category. If you’re into green energy, start here. They use tables to show costs and exposures. Makes it easy to compare. Personal tip: Watch global news for commodity prices. It helped me once with a small investment.

Healthcare Stocks: Insights from 5starsstocks.com

Health is always important. 5starsstocks.com mentions healthcare in their picks. Like Eli Lilly (LLY) in one article. It’s a pharma giant working on new drugs. They have stuff for Alzheimer’s. The site says it’s a growth stock with buy potential. Why? Strong earnings and market share. In dividend lists, Johnson & Johnson shines too. They make meds and devices. I’ve seen how health stocks hold up in tough times. People need care no matter what. 5starsstocks.com ties this to blue chip stability.

These companies have big moats—hard for others to copy. For value stocks, look for undervalued health firms. The site has AI in healthcare mentions. Like using tech for better care. If you’re worried about aging populations, this sector fits. They remind you of risks, like drug approvals. Always check FDA news. Overall, 5starsstocks.com makes healthcare investing less scary.

Blue Chip Stocks: Safe Bets on 5starsstocks.com

Blue chips are like the big players. Reliable and strong. 5starsstocks.com highlights them on the homepage. Think Microsoft (MSFT) from their invest list. It’s in cloud and AI. Huge growth. Another is JPMorgan Chase (JPM) for banking. Steady dividends. Why blue chips? They weather storms better. I held one during a dip—it bounced back. The site says they’re good for beginners. Mix with income stocks for cash flow. Blue chips often pay dividends. Like Procter & Gamble in staples. Everyday products keep sales up. For passive stocks, these are stars. Low effort needed. 5starsstocks.com suggests checking valuations. Don’t overpay. They have a value stocks guide too. It ties in. Personal story: A blue chip helped my savings grow slowly but surely.

3D Printing Stocks: The Future Tech Angle

3D printing is cool—it makes things layer by layer. 5starsstocks.com has a whole category for 3D printing stocks. It’s under tech sectors. These stocks could boom with manufacturing changes. Think printing parts for planes or meds. The site links it to innovation. No specific lists in my check, but they mention differences in tech stocks. I imagine picks like Stratasys or 3D Systems—common in this space. Why buy now? Growth in healthcare and military uses. Tie to defense stocks for strong parts. Risks? High costs and competition. 5starsstocks.com would say research fundamentals. For best stocks, look for leaders with patents. This fits value investing if prices dip. Personal insight: I saw 3D printing at a fair—it changed how I think about making stuff. If you’re into future trends, explore this on 5starsstocks.com.

Military and Defense Stocks on 5starsstocks.com

Defense is about protection. 5starsstocks.com lists military and defense stocks on the home page. These are for global security needs. Think companies making gear or tech. Like Lockheed Martin, but site doesn’t specify. They tie to materials like nickel for alloys. Why invest? Steady government deals. In uncertain times, these hold value. I recall defense stocks rising with news events. Risks include budget cuts. 5starsstocks.com suggests balancing with staples. For passive income, some pay dividends. Link to blue chips for stability. The site empowers smarter choices here. If world events worry you, this sector might hedge. Check their industry sections for more.

Materials and Lithium Stocks: Building the Future

Materials are basics like metals. 5starsstocks.com covers them, including lithium stocks. Lithium is for batteries in phones and cars. Their top picks article talks demand growth. Like Albemarle or SQM—common ones. Tie to nickel for EV boom. The site has basic materials 101. Explains impacts from global prices. Why buy? Green energy push. I invested in a materials fund once—up with tech demand. Risks: Price swings from supply. 5starsstocks.com warns about that. For value stocks, find cheap ones. This sector fits income if dividends flow. Explore for long-term plays.

Staples Stocks: Everyday Essentials

Staples are must-haves like food. 5starsstocks.com mentions them. In dividend lists, Procter & Gamble and Coca-Cola shine. They’re recession-proof. People buy regardless. The site says they’re good for stability. Tie to blue chips. For passive stocks, perfect. Low volatility. I like staples for peace of mind. Risks? Cost rises, but they pass to buyers. 5starsstocks.com helps spot best ones.

Value Stocks: Hunting for Bargains on 5starsstocks.com

Value stocks are underpriced gems. 5starsstocks.com has a beginner guide. Look at metrics like earnings. Industries like staples or energy. Why? Potential for big gains when market sees value. I found one once—doubled in a year. The site ties to income stocks. Many pay dividends. For best stocks to buy now, check here. Risks: Waiting for turnaround.

Income Stocks: Steady Cash Flow Ideas

Income stocks pay regular money. 5starsstocks.com explains in 101. Like dividends. Low risk, higher than bonds. Ideal for retirees. Tie to passive stocks. The site suggests yields above Treasury rates. I use them for extra income. Risks: Cuts if company struggles.

Passive Stocks: Easy Investing with 5starsstocks.com

Passive means set and forget. 5starsstocks.com has a category. Like index funds or steady dividends. Why? Less stress. For beginners, great start. Tie to all above. Personal tip: Start small.

Best Stocks to Buy Now from 5starsstocks.com

Mix picks like MSFT for tech, JNJ for health. Site says buy now for growth.

FAQs

What makes 5starsstocks.com different from other stock sites? It focuses on simple, research-backed picks across niches like nickel and healthcare. No hype—just facts.

How do I start with dividend stocks on 5starsstocks.com? Read their 2025 guide. Pick ones like PG for staples. Reinvest payouts.

Are nickel stocks risky according to 5starsstocks.com? Yes, due to price changes. But picks like VALE offer balance with strong setups.

What’s a good blue chip stock from 5starsstocks.com? Microsoft (MSFT)—growth and dividends.

Can I find 3D printing stocks on 5starsstocks.com? Yes, in tech category. Look for future trends.

How does 5starsstocks.com help with passive investing? Through income and value stocks for long holds.

Wrapping Up: Take Action with 5starsstocks.com

You’ve seen how 5starsstocks.com can guide your stock picks. From dividends to lithium, it’s packed with ideas. Now, head over and explore. Start small, learn, and grow your portfolio.

You May Also Like : 5starsstocks.com Stocks: Is It Worth Your Attention?